|

Back to Blog

What's the USD Index?9/27/2020 Image: Matteo Catanese on Unsplash

We often hear the USD is strong, weak, or flat. What does that mean? It's a reference to the USD Index (DXY) which is a weighted measurement against the performance of EUR, JPY, GBP, CAD, CHF, and SEK. EUR is the 57.6% fat guy in that group who at least brings a packed cooler to the cookout. A higher number represents strength and affects fiscal policy accordingly. Last Friday saw DXY at 94.577, a sign of hope based on yet another "stimulus" from the Fed and concerns about the other six currencies. As Clayton told us last week, the US government is running out of options to keep the train rolling.

Back to Blog

Eco Launch Delayed9/27/2020 Image: Eva Blue on Unsplash

Eight of France's former colonies in Africa including Côte d'Ivoire have stalled launching their group hug currency named eco. The union agreed to budget deficits <= 3% but are unable to achieve that as governments across the world pumped cash they didn't have into their economies to stave the effects of the plague. XOF/USD will open at 0.00176 somewhere today.

Back to Blog

Whoa, You'll Need This First9/27/2020 Image: Mike Yukhtenko on Unsplash

Cyprus requires at least a 2MM EUR property purchase and 6 months to gain citizenship. Wealthy Britons are applying for citizenship to Eurozone countries as Brexit finale dates approach and they need to travel more freely "for work." EUR/GBP will open at 0.912 today.

Back to Blog

French Makers Feel Better9/27/2020 Image: Fabrizio Verrecchia on Unsplash

France saw a three point increase to 96 in its manufacturing confidence survey last week. Confidence surveys are important because they reflect what managers think and not what governments report. We'll ask a farmer what's going on with the soil first. Many countries need manufacturers to be busy and even have backlog issues (not enough labor to meet production schedules) which force efficiency innovation up and down the supply chain. Open orders and committed costs are good indicators of what is really happening at a company and with its partners. EUR/USD will open at 1.163 today.

Back to Blog

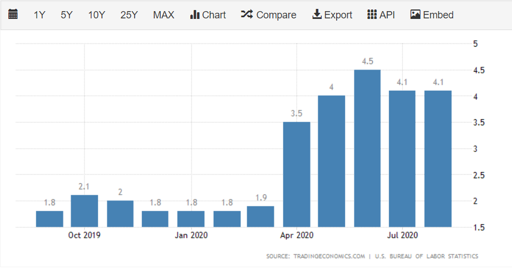

Have You Noticed Food Prices?9/20/2020 Image: Tradingeconomics.com via US Bureau of Labor Statistics

Our food is 4.1% more expensive than this time last year in the US which the Bureau of Labor Statistics reports monthly. In April, we wrote about how pigs and cattle are being slaughtered because that stop loss is cheaper than feeding and caring for them if they're not going to sell at their prime age/weight. Since then, the US has had major supply chain problems with some truckers flat refusing to deliver to hostile cities. Venezuela's cost of food is up 2,240% since August 2019.

Back to Blog

Image: Josh Johnson on Unsplash

Back to Blog

Finland OK9/20/2020 Image: Tapio Haaja on Unsplash

At only (only) a 4.5% decline in GDP, Finland appears to be fairing better than most of Europe. The push for work from home and rethinking office space is a tremendous capitalist improvement to come from the plague. Finland also boasts a cool approach to parenting. You know, the kind that involves staying at home and being trusted like adults to work while little ones recover. We embrace this shift in the workplace. However, you can't mine iron, bend steel, or lay fiber optic cable sat in your pajamas in between your first and second nap before picking up the kids. Dirty work will always need to be performed to provide resources for clean work. EUR/USD opens at 1.184 today.

Back to Blog

Iranian Rial Unwell9/13/2020 Image: Alireza Heydarifard on Unsplash

Do you remember oil going negative in April? It hurt everyone including Iran. The plague and economic strife have contributed to the country's struggles and the US sanctions in 2018 certainly are having an impact. USDIRR got as high as 255,000 last July. IRR halved its value to USD this year. In fact, the official rate for business is 42,000. That's a new one.

Back to Blog

Aircraft Parts Flood Market9/13/2020 Image: Yaroslav Muzychenko on Unsplash

Airline travel has, you know, slowed. This means carriers are looking to accelerate the retirement of older birds and have reached out to parts companies for bids to dismantle their planes. The scavengers then keep the inventory of parts to sell for repairs throughout the world. As the parts supply has increased, the demand has decreased (fewer planes anyway) and prices are at risk. What's the play? Hold off as long possible for buying parts as prices fall. Just in time is less of a consideration now as the conversation of quoting "price and availability" has changed. Manufacturers will endure this sympathy pain with their carrier clients.

Back to Blog

Image: Matthew Bennett on Unsplash

A 120 billion USD shortfall starting next year is significant. The forced donation of Americans' earnings via payroll tax and benefits tax will help to sustain payments. However, by 2035 "the Board of Trustees estimates that sweeping benefit cuts of up to 24% may be necessary to keep the Old-Age and Survivors Insurance (OASI) Trust solvent over the long term." You will be shortchanged in 15 years from benefits you continue to have no choice but to pay into. Low birth rates and income inequality take the blame for the current and future stress on the system (we'll exclude government mismanagement today). Wealthier people live longer thus draw from the benefits longer.

Back to Blog

K9/6/2020 Image: Tittee Parichad on Unsplash

In the US, a K shaped recovery is not the best recovery. Ideally, we want a V which represents overcoming a suddenly drastic hiccup. A K represents the gap between equities and economic strength. We're rooting for the lower path of K because that means the economy is growing responsibly and in the middle class. The upper path benefits those who already have wealth which is why the top 1% own 52% of the equities market. In August, 344,000 government jobs were added while manufacturing filled 29,000 spots. Construction benefited from 16,000 new (or returning?) positions and mining and logging lost another 2,000 jobs. It's awfully difficult to cut and move steel working from home.

Back to Blog

Meh, Four Day Work Week9/6/2020 Image: Jörn Sieveneck on Unsplash

Volkswagen will avoid the four day work week for now. The plague and electric vehicles, which are easier to build, appear to justify such a move as manufacturers all over the world cut staffs. However, with 7,000 employees already being "encouraged" to retire and separate, the people's car will hold off. This is the same company that put the battery under the driver's seat and built code to detect it was being tested and alter those live testing results, so who knows what to believe. EUR/USD will open at 1.184 today.

Back to Blog

Do You Have a Grasp on Pivot Points?9/6/2020 Image: Volodymyr Hryshchenko on Unsplash

DAILYFX is a great resource for trading. This chart helps you determine what the market is likely thinking based on resistance and support levels. Understanding pivot points will help you understand Clayton and that's no easy feat.

Back to Blog

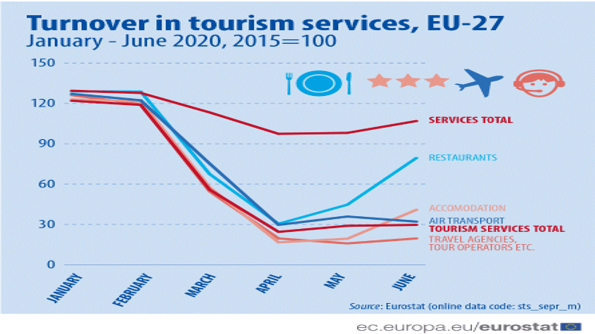

Tourism in Europe Crushed by 75%9/6/2020 Image: Eurostat

In June 2020, travel and tour dropped 83.6%, air travel lost 73.8%, room and board was down 66.4%, and restaurants suffered a 38.4% decline. EUR/GBP will open at 0.891 today. |

RSS Feed

RSS Feed