|

Back to Blog

Wood Ya?10/25/2020 Image: Joel & Jasmin Førestbird on Unsplash

Mid September saw lumber prices get close to the 1,000 USD per 1,000 board feet mark perhaps directly correlated to the 1.108 million new houses started. In Denver, there was a shortage of fire treated lumber, something we had never experienced. It made for tense conversations between purchasing agents and foremen. Calling Home Depot desperate for wood is an embarrassing venture for everyone and nobody wins. Lumber is now at 515.30 USD.

Back to Blog

German Manufacturing Rolling (Kind Of)10/25/2020 Image: Lenny Kuhne on Unsplash

Purchasing Managers' Index reflected a fourth month of growth for Germany. It includes the manufacturing and service sectors to gauge economic activity. Manufacturing rated 58.0 while service came in at 48.9. A value of 50 represents contraction. This is encouraging because like star athletes, strong economies need to perform when it counts. We know what happened to the service sector. Now, if they could just fix the unwanted tire pressure sensor that has spouses yelling at each other over mixed readings, we'd all be better off. EURUSD opens at 1.186 today.

Back to Blog

Big Enough For Junk10/25/2020 Image: Joshua Rodriguez on Unsplash

The Fed's response to the plague involved the PPP. As Rolling Stone wrote in July, even giant musical acts like the Eagles had their hands out. Bands that sell out arenas and stadiums in normal non-plague conditions are huge business. Other large businesses also benefited, seemingly unfairly, from the PPP. Relationships with bankers and access to serious money is a perk to running any business with significant cash flow. These bankers know other bankers and can create financing vehicles like junk bonds and BBQ handshakes with promises to pay later. This leaves the three piece band, you know, the one that has to pay to open for a larger act, in serious trouble. Almost 25% of small businesses have closed since the plague hit according to the Bloomberg article. This gap creates the opening for giant firms to swoop in and absorb the market. AMZN has doubled since mid March. Like government regulations, big businesses have the capital to absorb these drastic changes to their industries. The little guy will continue to play his guitar but if he wants to have a live audience it will have to be after his shift in the warehouse and in front of lattes and weird green chairs.

Back to Blog

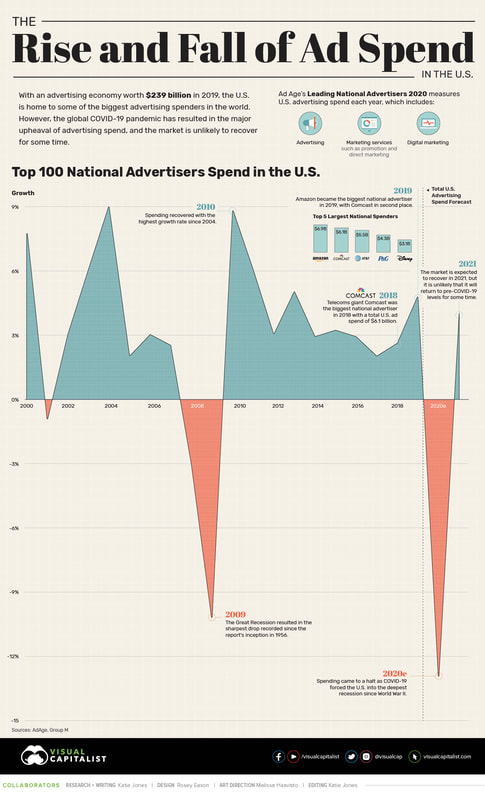

US Advertising Spend Down 13%10/18/2020 Amazon shelled out a cool 6.9 billion USD in 2019 to remind our wives that the company with the most annoying cardboard boxes is there for them. It won't hit those levels this year as all of US advertisement spend is expected to decline 13% excluding political ads.

Back to Blog

Plague and Brexit10/18/2020 In case you forgot, UK is dealing with the plague as well as Brexit and the official transition period is December 31. If UK doesn't budge and move to EU's demands, the divorce will be bitter and sudden. Sentences like that previous one are platitudes to summarize that it's a giant mess over there that involves trade, travel, and fishing rights.

UK businesses are worried about their supply chains as prices are sure to increase with trade bottlenecks from governments who can't be bothered to respond to group texts. I see your Schwartz is as big as mine.

Back to Blog

Oh, Johnny From The Warehouse Got In, Too10/18/2020 We talked about people taking their "stimulus" money (remember, governments don't stimulate anything) on the podcast and pouring it into their Robinhood accounts. With all that friction removed, it was easier than ever for retail traders to get in the action in the furious bull market this summer.

Back to Blog

Here We Go Again10/18/2020 Following a pattern of accepting a 20 USD bill from Dad before heading out Friday night, spending low risk money is still fashionable as long as others pay for it. Boston Fed President Eric Rosengren said he's expecting bankruptcies from companies that have, "gradually increased risk by taking on more leverage, which magnifies returns with good outcomes – but also magnifies losses when bad outcomes occur."

Back to Blog

Auto Parts Manufacturers Hurting for Labor10/11/2020 Image: Birmingham Museums Trust on Unsplash

|

RSS Feed

RSS Feed